The weighted average is used in various financial formulas. The SPDR SP Biotech ETF fund tracks the SP Biotechnology Select Industry Index an equal-weighted index that holds large- mid- and small-cap.

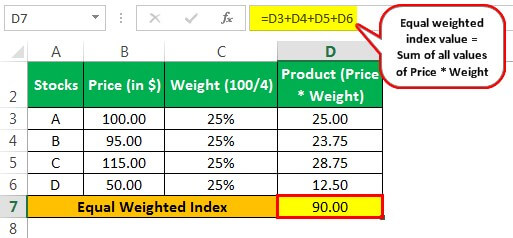

Equal Weighted Index Definition Formula And Examples

Spglobal Com

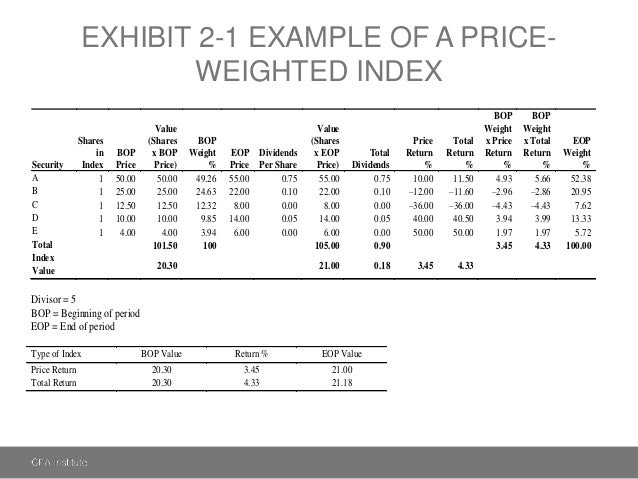

Investments Chapter2

Lets consider a numerical example that shows the usefulness of calculating dollar-weighted returns.

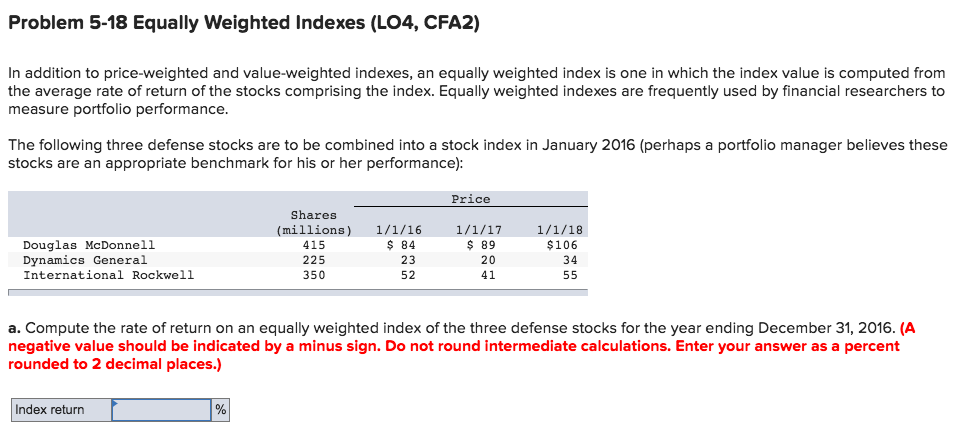

Equal weighted index example. Strong Buy greater than 66 Buy Buy greater than or equal to 33 Buy and less than or equal to 66 Buy Weak Buy 0 Buy through 33 Buy Hold. Over the past 10 years the SP MidCap 400 Equal Weight. Example 1 Calculation with the help of Sum Function.

When we do a simple mean or average we give equal weight to each number. In such an example the student would multiply the weighing of all assessment items in the course eg assignments exams projects etc by the respective grade that. A symbol will be given one of the following overall ratings.

Strong Sell greater than 66. For example the SP 500 Equal Weight Index quarterly to equal weight each stock in the SP 500 at the company level of 1500 002 While EWSC flies under the radar it turns 11 years old in December so its got a fairly lengthy track record and an impressive one at that. For example a price above its moving average is generally considered an upward trend or a buy.

An equal-weighted index is a stock market index comprised of a group of publicly traded companies Private vs Public Company The main difference between a private vs public company is that the shares of a public company are traded on a stock exchange while a private companys shares are not. Lets take the 8 10 records and try working with an Information Gain Split. The sum function is used to calculate the weighted average if the table contains a smaller number of datasets.

For example a student may use a weighted mean in order to calculate hisher percentage grade in a course. Weighted average or weighted mean is defined as from wikipedia The weighted mean is similar to an arithmetic mean where instead of each of the data points contributing equally to the final average some data points contribute more than others. Weighted least squares WLS also known as weighted linear regression is a generalization of ordinary least squares and linear regression in which knowledge of the variance of observations is incorporated into the regression.

The next step would be to take the results from the split and further partition. For example say an investor acquires 100 shares of a company in year one at 10 and 50 shares of the same stock in year two at 40. For example if you appear for exams and all the exams carry a similar weight then the average of your total marks would also be the weighted average of your scores.

Download The 12000 Word Guide. To calculate Weighted Average we must have a specific weightage for each variable taken as a value and the weightage must equal to 100. Opalesque Industry Update - The Scotiabank Canadian Hedge Fund Index ended September 2021 up 030 MOM on an asset-weighted basis and down 045 MOM on an equal-weighted basis.

The simplest capitalization weighted index can be thought of as a portfolio consisting of all available shares of the stocks in the index. When we calculate a simple average of a given set of values the assumption is that all the values carry an equal weight or importance. You may find an example in the Self-Parking Car in 500 Lines of Code article.

To get a weighted average of the price paid the investor. That is Z X RxWidx 0 i 12n 22 where the nuber of weight functions Wi is exactly equal the number of unknowconstants ai in u. Also called Weighted Average.

METHOD OF WEIGHTED RESIDUALS sense over the domain. Few examples of Weighted average beta and a weighted average cost of capital WACC. If all the weights are equal then the weighted mean and arithmetic mean will be the same.

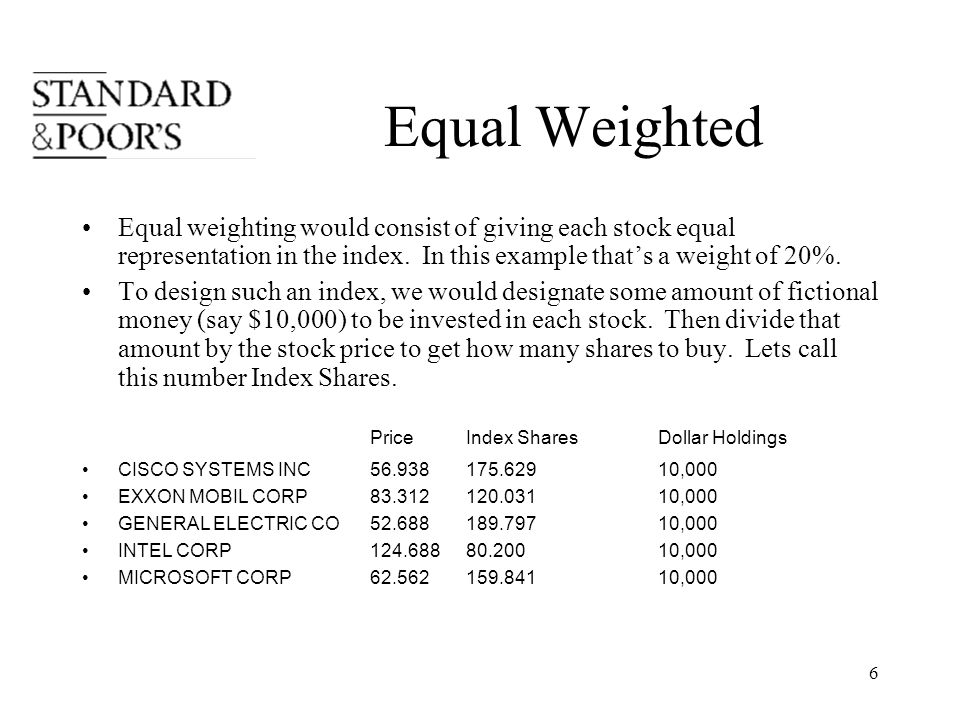

Here is the mean of 1 2 3 and 4. WLS is also a specialization of generalized least squares. That invests an equal amount of money in the stock of each company that makes up the index.

In particular lets compare the money-weighted rate of return and the time-weighted return of an investment. While one might track this portfolios value in dollar terms it would probably be an unwieldy number for example the SP 500 float-adjusted market value is a figure in the trillions of dollars. An equal-weighted index fund on the other hand takes the same set of companies and invests in them as equally as it can.

Theresultisasetof nalgebraicequationsfor the unknown constants aiThere are at least five MWR sub-methods according to the choices for. Options Trading 101 - The Ultimate Beginners Guide To Options. An SP 500 equally weighted index for example puts the same amount of money into Apple as it does into American Express.

In the Genetic Algorithm the weighted random is used during the Selection phase when we need to select the fitteststrongest individuums based on their fitness score for mating and for producing the next stronger generation. Applications of Weighted Random. The Scotiabank Canadian Hedge Fund Index provides a comprehensive overview of the Canadian Hedge Fund universe.

Add up the numbers divide by how many numbers. For example between the start of 1999 and 25 February 2021 the maximum time we have data for both indices the SP 500 provided a return of 3921 while the. Significance and Use of Weighted Average Formula.

Dollar-weighted rate of return example. A capitalization-weighted index is a type of market index with individual components that are weighted according to their total market capitalization. A mean where some values contribute more than others.

The SP SmallCap 600 Equal Weight Index generated average annualized returns of 112 compared with 105 for its cap-weighted rival according to Investopedia. The Weighted mean is calculated by multiplying the weight with the quantitative outcome associated with it and then adding all the products together. Based on these results you would choose Var232 as the split since its weighted Gini Index is smallest.

The weighted arithmetic mean is similar to an ordinary arithmetic mean the most common type of average except that instead of each of the data points contributing equally to the final average some data points contribute more than othersThe notion of weighted mean plays a role in descriptive statistics and also occurs in a more general form in several other areas of mathematics. If all the weights are equal then the weighted mean is the same as the arithmetic mean. Alright to be fair that.

In the below-mentioned example I have a dataset in column A which contains the brand name column B Price of each Brand column C Quantity Sold column D Sales Value.

Price Weighted Index Return Youtube

Solved Problem 5 18 Equally Weighted Indexes Lo4 Cfa2 In Chegg Com

1

Ppt Financial Markets Powerpoint Presentation Free Download Id 26868

How To Calculate Equal Weighted Index Sofi

Index Calculation Primer Roger J Bos Cfa Senior Index Analyst Standard Poor S Ppt Download

Investments And Portfolio Management Ppt Download

Calculating Return Value Weighted Index Youtube